History is sometimes less about logical decisions than it is about the confluence of forces and the egos of humans.

On 24 February 2022, Russia crossed the border into Ukraine, a continuation of the war which had seen the annexation of Crimea in 2014 and fighting in the Donetsk and Luhansk regions. The build-up of troops on Ukraine’s borders had been watched for months, and while the media and pundits debated whether it constituted a false threat or an invasion, the US was in no doubt.

A recent Washington Post article[1] detailed the behind-the-scenes struggle to convince leaders, including Ukrainian President Volodymyr Zelenskyy, that the war was imminent. Certainly, the press and social media was a sea of ongoing debate on the issue until the moment troops finally rolled across the border.

There is an assumption among the general public that, with intelligence resources at their fingertips, nations like the US, the UK and Australia have a great predictive ability for what will occur in regional points of conflict. The referenced Washington Post article tells two tales: Firstly, a story of how much can be inferred from good intelligence and, secondly, how hard it can be to alter the nature of events despite that intelligence.

It is not a new problem. Intelligence and assessments are predictions. Like all predictions, some are realised and some are not. Action derived from predictions that turn out to be less than accurate can be costly economically, in lives lost and on the political stage. They also have to be accepted by real humans with their own egos, desires and hopes. Humans are not machines and history and psychology tells us that humans do not necessarily make the ‘logical’ or expected decisions.

Predicting the actions of Russian President Vladimir Putin based upon logic made it hard to appreciate the risk. Logic did not seem to suggest a sound basis for a full invasion of Ukraine. There was rhetoric around a Russian fear of NATO expansionism, but it seemed to make little sense to invade Ukraine if that was the concern. By taking Ukraine, Russia would simply abut Poland, and therefore NATO, directly. Left alone, Ukraine remained a useful buffer zone, especially while the idea of Ukraine joining NATO seemed a less than certain proposition.

Was the invasion to protect against the historical risk of the invasion of Russia from across the North European plain which extends from France to the Urals? In that case, Poland would be the broader objective as it represents the narrowest part of the plain. But again, Poland is a NATO country, which brings a whole different calculus to any thought of attack. In any case, there didn’t seem to be anyone even vaguely suggesting that an invasion of Russia was being contemplated.

Much was then made of Putin’s desire to reunite the Soviet empire, to achieve glory, and to crush a perceived metaphoric ‘cockroach on the doorstep’. These are the rationales of emperors and marauders which seem hard to fathom in a 21st century world.

In recent weeks, with the war in Ukraine stretching past its sixth month, the focus shifted eastwards to the Taiwanese situation. The visit by US House Speaker Nancy Pelosi on 2 August 2022 sharpened that focus intensely. China reacted to the visit with predictable rhetoric and aggressive military manoeuvres around Taiwan. It all seemed in some ways to be part of the usual gameplay, albeit at a heightened tempo. The trick is determining if it is just that—the usual game—or something more.

As with the days and weeks leading up Russia’s enormous increase in activity on the Ukrainian border, the tension around Taiwan is evident. Even to armchair watchers following the action on mainstream and social media, something does not feel quite the same as before. The game has shifted perceptibly from the formulaic probe and response. It feels like the threads have tightened into a perceptible node from whence the outcomes could be different. Not will be different, just could be. A sliding door moment.

What are those threads that we, the general populace, see in our media and social media feeds as we watch from our armchairs?

It is a little harder to get firm reporting on China as COVID has seen the country locked down and there are far fewer foreign media in-country with less freedom of movement in a zero-COVID China. But there remains plenty to digest.

China is not immune from the impacts of COVID, which continue globally with critical labour shortages across a range of industries. Health and education are notable areas of high and difficult to supply workforce demand, however, these challenges are widespread, with shortages also impacting military recruitment targets and construction industries.

The impact of China’s COVID-zero policy appears to be straining industrial and economic activity along with population acceptance. Insider Intelligence[2]in April discussed the impact of lockdowns on manufacturing and the issues of stretched supply chains coupled with chip shortages etc due to the war in Ukraine.

Recent images from China on Twitter show graffiti on COVID test booths[3] as a possible sign of dissatisfaction with COVID zero.

The impact of climate change is another global factor from which China is not immune. Footage of the Yangtze River in drought[4] is as impressive as it is concerning.

While extreme drought and heat are straining energy and water supplies across the world, in China the severe heatwave has led to a shutdown of industry for several days due to a shortage of water and hydroelectric power generation in the Sichuan region, which gets 80% of its energy from hydropower[5].

The pressures on the Chinese economy are also being reported[6] in the debt-laden Chinese construction and property sectors. The Guardian article discusses speculation of a government bailout as apartment buyers band together to withhold payments on unfinished homes in a market that already has liquidity issues. This follows as Evergrande, a major Chinese property developer which ran into trouble defaulting on offshore debt in 2021, moves towards announcing restructuring plans.

Evergrande is not the only Chinese property developer to experience difficulties, as seen in this ABC report from May on Sunac, China’s third largest developer founded by billionaire Sun Hongbin.

‘Last week, his firm—China’s third-largest developer—defaulted, missing the deadline for coupon payments on a $US742 million ($1.1 billion) offshore bond.Unlike Evergrande, which defaulted in December last year, Sunac appeared to be financially healthy and the boss, Mr Sun, had previously been diligent in repaying debts.’[7]

In recent months, a number of other Chinese development companies have seen a drop in their share prices and had their Moody’s ratings downgraded as sales demand contracted.[8]

Reading articles about the Chinese construction and property development industry certainly gives an impression that there is a persisting instability in an area that had driven a large amount of funding for the Chinese economy as noted in The Diplomat, among others.

‘Real estate prices in China’s major cities are some of the most expensive in the world, and the property market has been a key driver of economic growth since the “reform and opening” period.’[9]

A recent article by Peter Hannam in The Guardian[10] summarised many of the broad economic challenges facing China, including a drop in the IMF forecast for GDP growth, a failure to meet economic expectations across multiple targets and the rise of youth unemployment in cities to 20%. He also makes reference to the ageing population which has long been a concern for China.

While China’s internal economic challenges may impact international trade and tourism, and potentially the Belt and Road Initiative, many watchers are pondering the more near-term ramifications for Chinese President Xi Jinping as the 20th Communist Party Congress looms large.

In 2018, China removed the two-term limit on the presidency, effectively allowing Xi to remain President for life[11]. Russia made similar tweaks to its constitution to allow Putin to stay in power until 2036. The two men now sit on a very small peak at the pinnacle of power. The only way is down for both of them and that cannot look like an attractive proposition.

Staying balanced on that narrow point would be easier with a broad base of support and stable foundations. However, it is debatable how broad a base either man can muster. Taking power and holding it are two different propositions, especially amidst a deadly pandemic, climate change impacts and uncertain economic times.

At the next Communist Party Congress, which is due shortly, Xi is expected to put his hand up for a third term as General Secretary of the CCP. The Standing Committee of the Politburo will also be selected. All in contention are undoubtably watching both internal and external pressures closely. A population under rolling COVID lockdowns, straining industry sectors coping with the impacts of the pandemic, supply chain disruption, water and energy shortages, pressures in the property development sector—not to mention recent issues in regional banks—surely creates an uncertain footing domestically.

Externally, Xi and his compatriots will be watching the response of the world to Russia’s attack on Ukraine. China has tried to walk a narrow road without robustly condemning the war, and recently engaged in military exercises with Russia, an action showing implicit support.

The war in Ukraine is an interesting demonstration to the Chinese as to how far the global community—and the US in particular—will go financially and militarily to support Ukraine against Russia. The war is also a drain on US and international economic and military resources as funds and equipment are sent to Ukraine in lieu of troops. There is a window while the war is active in Europe for Xi to capitalise upon it if he chooses. A window where the US is not fully focused upon the Indo-Pacific as resources and attention are flowing to Europe.

How great is the Ukraine distraction? Would it hinder the speed or gravity of a US-led response in the Taiwan region? Does Xi lie awake at night pondering his internal situation and this possible window of opportunity? Does he ponder the nature of his own position atop a narrow peak of power? What is the level of concern among his colleagues that their own potential for ascending to power is impacted by the changes allowing Xi to remain as President?

As the armchair watchers nibble their popcorn and flick through their Twitter timelines, they watch for clues. Recent Chinese actions around Taiwan have been a little stronger, the rhetoric less rote and more specific in warning the US against FONOPs in the Taiwan Strait. The global pressures are also greater, with a pandemic and climate change intersecting with manufacturing and supply chain difficulties.

There are rumours of secret military meetings, and leaks on social media, purportedly suggesting the invasion of Taiwan is more imminent than not. The next suitable time for a mass crossing of waters of the Taiwan Strait is said to be in October, typhoons permitting—around the same time as the Communist Party Congress. Is this significant or are there players within China who are using leaks to put pressure on Xi?

As this recent War on the Rocks article states: ‘It is tempting to discount China’s actions as purely performative, but the exercises could have several long-term political and military repercussions that weaken Taiwan’s security[12].’

The article goes on to discuss the fact that China is pushing the boundaries in its grey zone activities around Taiwan without much pushback on the international stage. The landing of missiles in Japan’s EEZ for the first time also substantially enlarged the envelope of what might be part of the new normal in Chinese military exercises.

China is also dancing on the median line in the Taiwan Strait, a line which exists by convention, not law. Like a chalk boundary in the playground, the more you shuffle on and across it, the faster it disappears into irrelevance.

Has China turned up the heat on the proverbial boiling frog or are they merely indulging in more of the same games countries play? It is not an easy question to answer but it does feel different. And what interpretation should be drawn if one of the players has opened a new rule book?

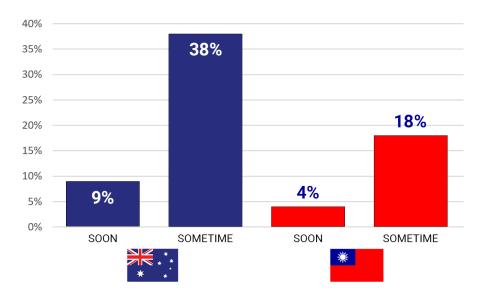

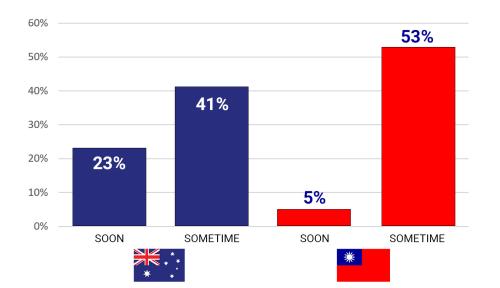

Interestingly, the Australia Institute has released the results of an online survey[13] undertaken between August 13-16 2022 of 1003 adults living in Australia and 1002 adults living in Taiwan.

In answer to the questions:

Do you think China will launch an armed attack on Australia?

Do you think China will launch an armed attack on Taiwan?

Sometimes, those living under a near possible threat perceive it as less of a concern than those watching from a distance. The everyday reality for those living in Taiwan is that the potential for invasion has long been part of life. It may well be easier for the Taiwanese to see recent events as more of the same. And they may well be right. Any attack by China that stops short of an outright invasion of the island would gain little but aggravation from Taiwanese allies.

It is also important to remember that as the recent war in Ukraine was poised to escalate, Zelenskyy repeatedly pushed back on the reports that an invasion was imminent to keep both the populace and the markets from becoming skittish. There are many different factors that can influence the opinions of those under threat and those at a safer distance, as situations look different when seen through a variety of lenses.

As a watcher on the sofa, the confluence of threads appears to be forming a node. When we see a node in history, we ponder a little more, hold our breath a little longer and spend more time refreshing the news and our timelines looking for hints as to what happens next.

Footnotes

1 Shane Harris, Karen DeYoung, Isabelle Khurshudyan, Ashley Parker and Liz Sly, Washington Post 2022, Road to war: U.S. struggled to convince allies, and Zelensky, of risk of invasion, viewed 2022-09-12, https://www.washingtonpost.com/national-security/interactive/2022/ukraine-road-to-war/

2 Gadjo Sevilla, Inside Intelligence 2022, Manufacturing in China falls to a 5-month low due to pandemic lockdowns, viewed 2022-09-12, https://www.insiderintelligence.com/content/manufacturing-china-falls-5-month-low-due-pandemic-lockdowns

3 Stephen McDonell, Twitter, 2022, viewed 2022-09-12, https://twitter.com/StephenMcDonell/status/1561595471277072384?s=20&t=UiGoXu0_awxTimdYKtMXDA

4 @Flash_news_ua, Twitter, 2022, viewed 2022-09-12, https://twitter.com/Flash43191300/status/1561804003461177344?s=20&t=UiGoXu0_awxTimdYKtMXDA

5 Helen Davidson, The Guardian, China drought causes Yangtze to dry up, sparking shortage of hydropower, viewed 2022-09-12, https://www.theguardian.com/world/2022/aug/22/china-drought-causes-yangtze-river-to-dry-up-sparking-shortage-of-hydropower?utm_term=Autofeed&CMP=twt_gu&utm_medium&utm_source=Twitter

6 Martin Farrer, The Guardian, China property sales could plunge by one-third, analysts say, as crisis deepens, viewed 2022-09-12, https://www.theguardian.com/business/2022/jul/27/china-property-sales-could-plunge-by-one-third-analysts-say-as-crisis-deepens

7 Samuel Yang, ABC News, Chinese developer Sunac defaults as Beijing struggles to save the trillion-dollar sector, viewed 2022-09-12, https://www.abc.net.au/news/2022-05-20/chinese-developer-sunac-defaults-on-dollar-bond/101077934

8 Kenji Kawase, Nikkei Asia, China property developer sales 'falling off a cliff' , viewed 2022-09-12,https://asia.nikkei.com/Business/Markets/China-debt-crunch/China-property-developer-sales-falling-off-a-cliff

9 Edward Witte, The Diplomat, 2021, Property, Prestige, and ‘Common Prosperity’: China’s Real Estate Market in 2021, viewed 2022-09-12, https://thediplomat.com/2021/09/property-prestige-and-common-prosperity-chinas-real-estate-market-in-2021/

10 Peter Hannam, The Guardian, China’s economy is losing momentum, What is happening and why does it matter for Australia?, viewed 2022-09-12, https://www.theguardian.com/world/2022/aug/23/chinas-economy-is-losing-momentum-what-is-happening-and-why-does-it-matter-for-australia?CMP=share_btn_tw

11 BBC News, 2018, China's Xi allowed to remain 'president for life' as term limits removed, viewed 2022-09-12, https://www.bbc.com/news/world-asia-china-43361276

12 Bonny Lin and Joel Wuthnow, War on the Rocks, Pushing Back Against China’s New Normal in the Taiwan Strait, viewed 2022-09-12, https://warontherocks.com/2022/08/pushing-back-against-chinas-new-normal-in-the-taiwan-strait/

13 The Australia Institute, 2022, Research Shows Impact of Fearmongering: Australians more Frightened of China than Taiwanese, viewed 2022-09-13, https://australiainstitute.org.au/post/research-shows-impact-of-fearmongering-australians-more-frightened-of-china-than-taiwanese/

Defence Mastery

Please let us know if you have discovered an issue with the content on this page.

Comments

Start the conversation by sharing your thoughts! Please login to comment. If you don't yet have an account registration is quick and easy.